As the last quarter of the year approaches, every business owner should take a moment to assess whether the company’s finances and documents are in order and ready for the next year. While your accountant can do a lot in this regard, a truly clear picture of the actual situation emerges from the collaboration between you, as the leader, and your accountant. To facilitate this, we’ve compiled a practical checklist to help you review important financial topics before year-end. This way, you can start the new year with renewed vigor and avoid spending unnecessary time on old year’s problems.

1. Review Expenses and Tax Efficiency

Year-end is the best time to critically evaluate your company’s expense structure. Ask yourself:

- Are all expenses commercially justified and documented?

- Are there expenses that are reasonable to incur before year-end – for example, necessary tools, training, or marketing investments that will support growth in the coming year?

- Have expenses related to employee well-being (gifts, events, health promotion costs) been incurred and are they considered fringe benefits?

Hint: Tax benefits that are worth using before year-end, as they do not carry over to the new year – entertainment expenses, employee health promotion expenses, donations to tax-privileged organizations.

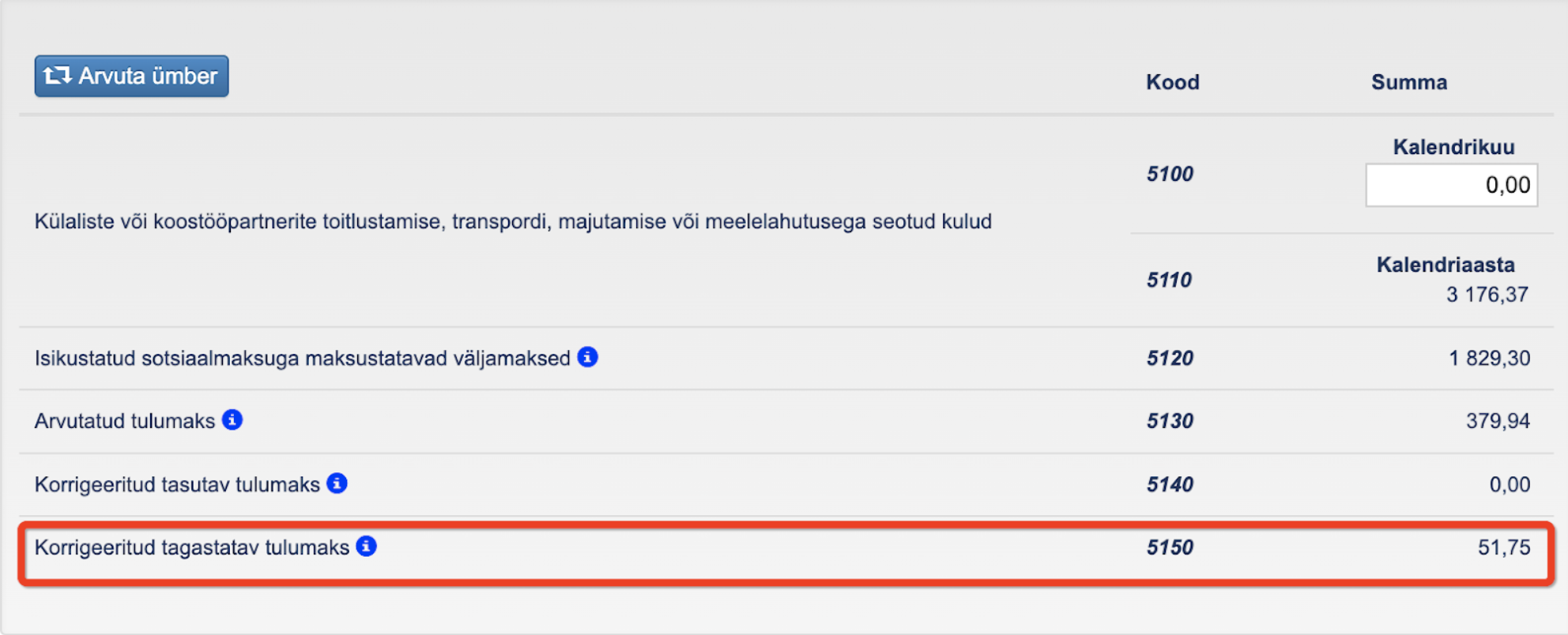

NB! Small business owner, if you submit your TSD (Tax and Social Contributions Declaration) related to entertainment expenses only a few times a year, i.e., not monthly – definitely submit a TSD in December, even if you have no entertainment expenses that month. Why? Because if entertainment expenses exceeded the tax-free limit in some months (and a fringe benefit obligation arose) and in some months no entertainment expenses arose at all, a year-end recalculation will be performed, and it may be possible to get back the income tax paid on fringe benefits.

Tax-efficient expense planning does not mean spending at any cost – it means smart, informed, and timely decisions to ensure the investment works for your company. Your accountant can certainly provide good advice in this regard.

2. Check Contracts and Cooperation Partners

If cooperation has lasted for several years, contracts may expire or require changes and updates. The last quarter of the year is well suited to:

- review all service and rental agreements – are the terms still suitable and favorable for your company?

- ensure that all partners have submitted invoices and that work has been correctly performed and accepted;

- assess whether any fixed costs (e.g., software licenses, administration contracts) need to be changed or cancelled.

This is also a good time to ask, does your company’s accounting partner meet your expectations and are they sufficiently modern? If information still flows via emails and Excel, it might be time to consider a new partner who uses cloud-based and automated paperless solutions to save both their and your time and resources.

3. Conduct Inventory of Goods and Fixed Assets

If your company has goods, materials, or equipment, then before year-end, these should, of course, be physically counted and compared with accounting records. This is an obvious activity, but it requires separate time planning.

- Check that all fixed assets exist and are in working order.

- Does any asset need to be written off or depreciation adjusted?

- Does the value of inventory correspond to the actual market value?

A thorough and correct inventory is one of the most important steps to avoid later problems in reporting and gives you a more accurate picture of the company’s real situation.

4. Evaluate Investment Profitability and Relevance of Future Plans

Naturally, it is good and reasonable for plans to be made for several years – consistency and a long-term vision are the foundation of success. But it is equally reasonable to adjust these plans as needed and according to changed circumstances. And again – the best time for this is the last quarter of the year. So, critically review, based on your goals:

- ongoing or planned investments;

- financial indicators (profit, cash flow, equity);

- opportunities to increase revenue and optimize costs.

- investment and crypto platform reports, and be sure to send them to your accountant in good time!

If you are planning new investments, it is wise to discuss them with your accountant early – this way you can assess when is the most favorable time to make the transaction, for example, whether to invest before or after the end of the financial year, or whether there are ways to optimize the expenditure differently.

5. Check Compliance of Equity with Law, i.e., Does it Constitute at Least 50% of Share Capital?

If not, the following questions may help:

- Has the share capital been paid in?

- Has your company lent money to the owner?

- Does your company have ongoing projects?

- Does your company have fixed assets or real estate?

- Does any of your company’s expenditure fit under fixed assets?

- Does your company have goods for sale that have not yet been taken into stock or is the inventory for the current year not yet compiled?

If it becomes necessary to make changes to equity or share capital, these must definitely be done within the current calendar year. Otherwise, they will only be reflected in next year’s report.

6. Determine if Your Company Has an Audit/Review Obligation?

You can discuss this with your accountant or use the Estonian Board of Auditors calculator to check if your company has an audit or review obligation. The sooner you start looking for an auditor, the more likely you are to reach an agreement with them to ensure the annual report is submitted on time. Acting promptly is important because there are many audited companies, but few auditors! So:

- Find out if your company has an audit or review obligation.

- If your company’s economic indicators do not yet exceed the thresholds, subjectively assess whether this could still happen by the end of the financial year.

- If the thresholds indicate an audit obligation, start looking for an auditor.

7. Keep an Eye on New Year’s Legal Changes

Your accountant will certainly do this too, but as an entrepreneur, it is also necessary and useful knowledge. Changes that you must definitely take into account when preparing the budget include, for example:

Related to salaries:

- New year’s minimum wage

- New year’s minimum hourly wage;

- Income tax exemption;

- Pension system changes;

- Conditions and application for partial work capacity benefit;

- Changes to children’s days/sick days system.

- Changes to the Employment Contracts Act.

Related to taxes:

- Income tax;

- Minimum income tax exemption amount;

- VAT;

- Unemployment insurance;

- Minimum import amounts without taxes;

- Excise duties;

- Changes in tax benefit conditions:

- Tax-free limits for personal car use compensation (cost per kilometer and monthly cost);

- Tax-free limits for per diems and accommodation expenses for business trips;

- Employee health promotion expenses;

- Entertainment expenses;

- etc.

8. Collaboration with the Accountant – Keyword: Prevention

Most importantly: don’t leave the collection of documents and information until the last minute. An accountant can only be a true strategic partner if they have all the necessary data and clarity on management’s plans. Together with your accountant, create a schedule that includes:

- deadlines for submitting documents,

- reporting dates,

- plans for budget creation or updating.

Good and systematic cooperation means clear agreements and a calmer year-end and stress-free January – in addition to reliable figures on which to make informed decisions.

In Summary

Preparing for the year-end stretch is not just a tedious obligation, but an opportunity to:

- save on taxes (legally and lawfully, of course),

- organize your finances and update contracts,

- make room for growth and development.

If you want your company’s year-end to go smoothly and systematically, be sure to contact your accountant in good time on this matter – by planning together, you will certainly gain more benefits than by chasing and correcting documents retrospectively.

Recent Comments