The pace of the business world is constantly accelerating. As products and services reach the market with increasing speed, so too must invoicing processes. The quicker an invoice reaches the buyer, the sooner the seller receives payment – a simple principle. The clear distinction between traditional paper invoices sent via post or PDF invoices – which require creation, email transmission, and manual entry into accounting software – and e-invoices, which move between systems with a few clicks, should highlight the advantages of the latter. However, as many entrepreneurs still do not fully trust e-invoicing, we delve deeper into the subject.

1. What is an E-Invoice and How Does it Function?

Despite initial hesitations, an increasing number of companies and organizations in Estonia and worldwide are opting for e-invoicing between various parties, i.e., B2B, B2G, and B2C. Notably, public sector institutions in Estonia have been legally required to accept e-invoices since 2019. In the B2B context, clients may request e-invoices from July 1, 2025, if they have registered as e-invoice recipients in the Commercial Register. While sending e-invoices to private individuals is not yet mandatory, a growing number of private clients prefer to pay for monthly subscription services (e.g., telecommunications, utilities) directly through their online bank via e-invoice due to increased speed and convenience.

What does an e-invoice entail? An e-invoice is not a PDF invoice transmitted via email, as is often assumed. It is a machine-readable document in a specific XML format. E-invoices created in Estonia must comply with the European Union Council’s standard EN 16931.

2. How Do E-Invoices and PDF Invoices Differ?

The distinction is straightforward. While a PDF invoice can be digitally created and transmitted, the recipient must still manually enter it into their system and retain it appropriately. This process consumes both time and ultimately space.

An e-invoice, or electronic invoice, on the other hand, is created, transmitted, approved, recorded, and stored entirely within an electronic environment. This means that an e-invoice automatically moves from one accounting program to another – from seller to buyer – with essentially a couple of clicks, without anyone needing to re-enter data. There is no need to fear that the invoice data will be in an unreadable, encrypted format; both parties can still view the e-invoice in the familiar PDF format.

3. What Are the Advantages of an E-Invoice?

The benefits of e-invoices are therefore quite apparent:

- Speed and Convenience: One simply needs to enter a few data points, make some selections and clicks, and the invoice moves between the seller’s and buyer’s accounting software in seconds.

- Fewer Errors: Mistakes associated with manual data re-entry are eliminated.

- Enhanced Security: E-invoices are sent and received by logged-in users, data is transmitted encrypted between systems, and every step leaves a log, enabling senders to verify, among other things, whether the document has been delivered.

- Economy: Studies indicate that receiving an e-invoice can be, on average, 5 euros more cost-effective for a company than processing a paper or PDF invoice, as it simplifies, and even reduces, the work of multiple individuals and eliminates the need to store PDF documents in folders or even paper binders (in addition to paper and folders, this also saves space).

- Environmental Friendliness: Less paper and fewer email attachments (server capacity).

- Reliability: Invoices do not get stuck in someone’s inbox or end up in spam.

- No Recipient Address Required: While a PDF invoice requires knowledge of the recipient’s physical or email address, for an e-invoice, it suffices to know whether the recipient has registered to receive e-invoices.

4. How to Create and Send E-Invoices?

This process is not complicated and generally does not require specialized programs or software. Technically, e-invoices are transmitted over the web and through operators. In Estonia, e-invoice operator services are provided by, for example, Telema, Finbite, Unifiedpost, e-RIKi e-arveldaja, Amphora, Billberry, Isolta, Envoice, among others.

For companies with a smaller volume of invoices, e-arveldaja is a good solution, but several other operators also offer free e-invoice sending capabilities.

If the number of invoices exceeds ten per month, or if you wish to receive e-invoices, it is advisable to consider subscribing to a more advanced and capable solution from an operator. Even if you choose a paid version of an operator service, this cost – 0.01 EUR per invoice – represents only a marginal portion of the cost of creating, transmitting, receiving, entering, and storing traditional invoices.

Steps for Sending an E-Invoice:

- Select a suitable operator and create an account.

- Integrate the solution with your accounting software or use the operator for invoice transmission.

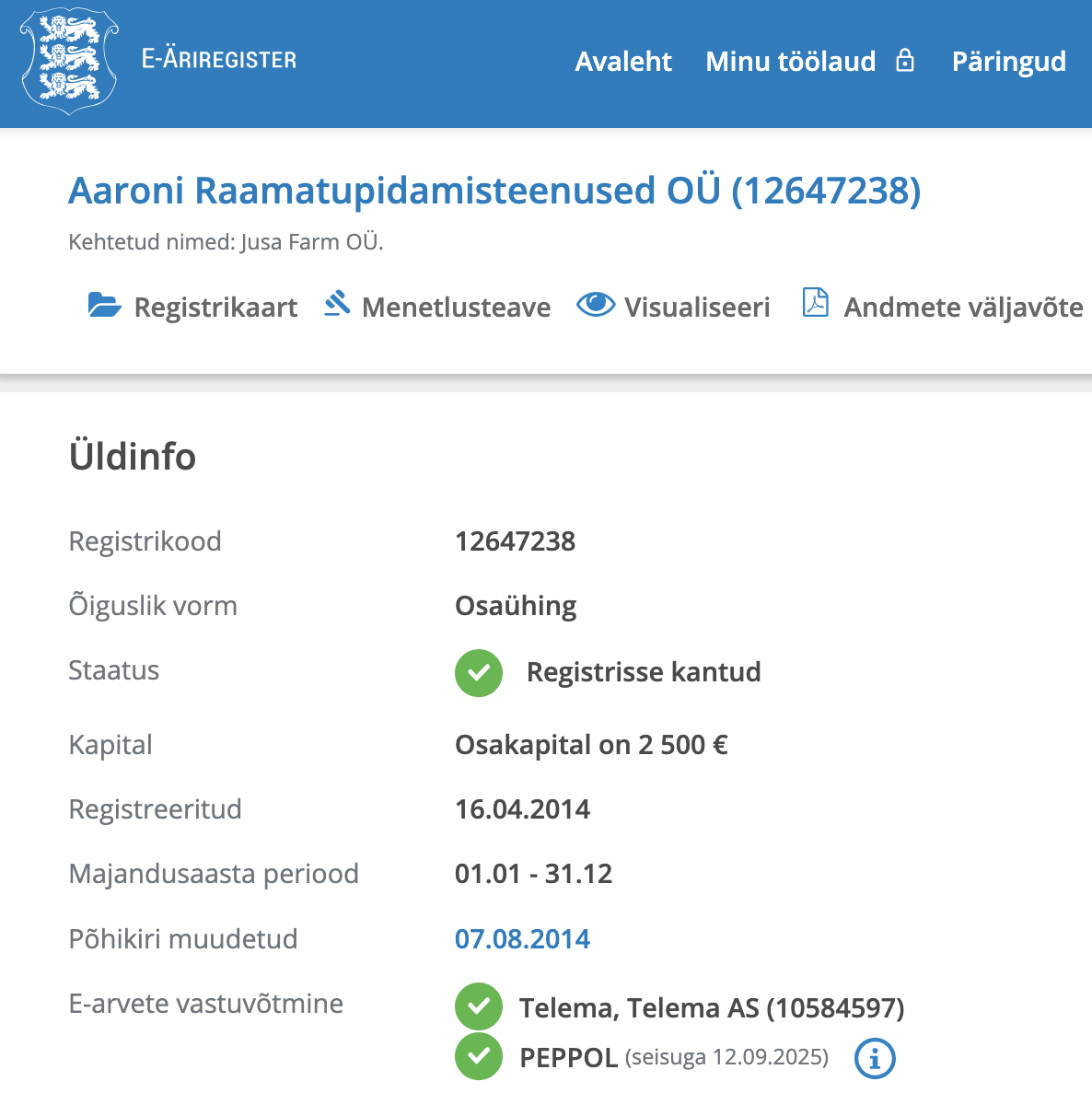

- Verify that your client has registered as an e-invoice recipient (if so, there will be a corresponding note in their data, see the photo below).

- Enter client and invoice data (including the buyer’s registration code).

- Send the invoice from the system – it will be in the partner’s software within seconds.

Receiving an E-Invoice:

- Choose an operator, enter into a contract, and mark in the Commercial Register that you are ready to receive e-invoices (see how to do this).

- Inform partners that you will henceforth expect e-invoices.

- Incoming invoices move directly into your accounting software – manual entry is no longer necessary. For a smaller volume of purchase invoices, you can also “order” them to your online bank (if you do not need to view, divide, group, etc., them separately for overview purposes) and enter into a standing order agreement with the bank for automatic payment.

If you need to send e-invoices abroad, you may inquire whether your e-invoice operator (for example, Telema in our case) is a PEPPOL Access Point to translate invoices into the unified European Union standard.

5. How Does E-Invoicing Function as an Aaroni Client?

In short, the answer is – very conveniently! For Aaroni clients, domestic e-invoice sending and receiving are, of course, included in the service fee. It is also possible to send and receive e-invoices from Finland, but in such cases, an invoice-based additional fee set by the operator applies. Should you wish to view invoices in PDF format, you only need to request it from us. With a paid additional user for Merit Aktiva, it is also possible to check every invoice in PDF view yourself – though the practicality of this is debatable – it is better to use the time saved from dealing with invoices to grow your company.

Another significant advantage for Aaroni clients is that our accountants themselves prepare payment orders for incoming invoices in your online bank, so you only need to log in and confirm the payment. This advantage is also free for our clients.

6. What Has Been Estonia’s Journey Towards E-Invoicing?

Estonia has been among the pioneers in the adoption of e-invoices, following the Nordic countries.

- From July 1, 2019, the entire public sector (ministries, local governments, foundations, schools, hospitals, etc.) has been required to accept only e-invoices.

- On July 1, 2025, amendments to the Accounting Act ((RPS § 71,(7)) entered into force, according to which the buyer now has the right to choose the invoice format. This means that if the buyer has registered as an e-invoice recipient in the Commercial Register, they have the right to demand an e-invoice from the seller (unless otherwise agreed).

- By 2027, there are plans to make the use of e-invoices mandatory between all VAT-liable entities operating in Estonia. This is currently under discussion within the government.

- From 2030, e-invoices will become the mandatory standard for cross-border transactions throughout the European Union.

In conclusion, the e-invoice is an excellent method for saving a company time and money. If you wish to make your accounting faster, more secure, and more sustainable, now is the opportune time to adopt e-invoices, rather than postponing it until the last moment when it becomes mandatory for everyone across Europe.

Do you have questions about e-invoicing and Aaroni’s capabilities? Contact us, and we will gladly clarify.

Recent Comments